The transition to transportation electrification so critical to U.S. net zero emissions ambitions may depend on better utility strategies to manage vehicle charging, power system analysts said.

Electric vehicles were under 1% of U.S. light duty vehicles in 2022, according to J.D. Power, but were 7% of new vehicle sales, the Alliance for Automotive Innovation reported March 23. Unmanaged, the anticipated electricity demand from the federal 2030 goal of making 50% of new vehicle sales electric, reinforced by new Environmental Protection Agency tailpipe emissions standards, could threaten power system reliability, the analysts acknowledged.

That is why “EV advocates support managed charging programs with new rate designs and direct utility charger control programs that compensate customers and allow third party participation,” said North Carolina Clean Energy Technology Center, or NCCETC, Associate Director, Policy and Markets, Autumn Proudlove. Managed charging “can benefit EV owners, other customers, utilities, and protect reliability,” she added.

With leading utilities now proposing time varying rates, or TVRs, and new approaches to the demand charges that impede high-volume charging, rate design is evolving, subject experts said. Changing prices in TVRs can vary in real time, by daily price periods, or with extreme demand events, to signal changing system demand, July 2022’s EV Retail Rate Design 101 from Lawrence Berkeley National Laboratory said.

Duke Energy has “redesigned” its TVR “to provide consistent price signals for all customers,” said Duke Senior Vice President, Pricing and Customer Solutions, Lon Huber. Its “hourly-price option,” will support EV fleets and high-volume “fast charging,” and avoid “indiscriminate demand charges” that unnecessarily add costs to charging that might otherwise threaten its economic viability, he added.

More dynamic TVR will work for residential EV charging, utility rate design analysts, EV advocates and researchers agreed. Opinions vary, however, on how precise TVRs need to be and on how to adjust demand charges for high-volume charging to avoid impeding vitally needed charger deployment.

Time varying rates for everybody

Most state policymakers are developing new policies and rate designs to support distributed energy resources, or DER, including EVs and charging infrastructure, NCCETC’s Proudlove and others monitoring state regulatory activity said.

All rate design, including for transportation electrification, should align customer choices with usage that minimizes system costs, according to Regulatory Assistance Project Senior Associate Mark LeBel. New system-wide residential TVR designs can link usage and system cost and avoid “adverse impacts” to utility revenues or customers, LeBel said.

Changing customer load patterns, rising penetrations of variable renewables, and customer access to smart technologies “undermine justifications for traditional flat rate designs,” LeBel said. TVR can recover utility revenues through rates while eliminating “inefficient” fixed demand charges that “overcharge” off-peak usage and “undercharge” peak usage, he added.

With enabling technologies, customers on TVR can shift usage from expensive peak periods and increase power system flexibility to reduce customer costs and support economy-wide electrification, according to a series of Energy Systems Integration Group papers released in January. But by 2019, only 1.7% of residential customers were enrolled in TVRs, reported NRG Energy Vice President of Regulatory Affairs Travis Kavulla, the former Montana Public Service Commission chair and ex-president of the National Association of Regulatory Utility Commissioners.

“EVs, as a side benefit, can take advantage of lower-cost TVR periods for charging” to make transportation electrification more cost effective than gasoline-fueled vehicles, and lead to wider adoption of transportation electrification, RAP’s LeBel and others agreed.

Rate design for EVs

The U.S. EV market’s $28.24 billion value in 2021 will reach $137.43 billion in 2028, a February 2022 Fortune Business Insights report forecast. Charger deployment may need to grow 20 fold, McKinsey & Company’s April 2022 analysis added. To manage the associated electricity demand, regulators are approving new TVR designs for EVs, NCCETC’s February 2023 national EV policy update reported.

TVRs “are a passive managed charging option for customers,” said NCCETC’s Proudlove. “Direct utility control of the charger is the active managed charging option, which utilities prefer because it gives them greater visibility to load.”

To give customers control, some utilities are testing TVRs paired with critical peak period rates that increase the incentive for charging curtailments during infrequent extreme demand events, Proudlove said. To use TVRs effectively, customers may require as yet not widely available smart chargers, programmable vehicle telematics, or separate meters, she added.

A less common alternative are subscription rates that give utilities even greater direct control of charging in exchange for “almost unlimited off-peak charging” at a simple, flat, low rate, Proudlove said.

All these options have been proposed to regulators, and some have been approved with the support of EV advocates, Proudlove said. But regulators, utilities and EV advocates are watching closely for as yet limited conclusive results, she said.

New EV rate structures with TVRs were considered in 31 states during 2022, NCCETC reported. In California, with 39% of all U.S. EVs, the three dominant investor-owned utilities, Pacific Gas and Electric, Southern California Edison and San Diego Gas and Electric, already offer multiple EV-specific TVR plans.

Acceptance by drivers may be emerging.

Through November 2022, increasing numbers of PG&E customers were using its default EV TVR and charging off-peak, utility spoksperson Paul Doherty reported. The estimated 80,000 customers on SCE’s TOU-D-Prime TVR have seen $216 per year in median savings by reducing summer peak demand “20.4%, or 0.47 kW,” and enrollment is growing “4% to 5% per month,” said SCE spokesperson Paul Griffo.

Other states are at the pilot or regulatory proposal stages. Avangrid New York’s OptimizEV program is piloting TVR offerings and Massachusetts House Bill 5060, enacted in August 2022, requires state IOUs to file proposals for residential EV TVR for implementation by Oct. 31, 2025.

EV TVRs for El Paso Electric, Xcel Energy Colorado and Arizona Public Service were approved in 2022 and similar proposals for Arizona’s two other IOUs, Tucson Electric Power and UNS Electric, are pending. After a December 2021 Guidehouse evaluation showed customers responded to an Evergy Missouri TVR pilot, state regulators ordered the utility to move all its customers to a range of TVR options by the end of 2023.

A multi-part TVR and subscription plan from PREPA, Puerto Rico’s IOU,was approved in January 2023, according to NCCETC. Austin Energy recently added a flat $0.21/minute rate for the city’s more than 25 fast chargers to its ongoing subscription plan with unlimited charging for $4.17/month at its over 1,000 Level 2 public chargers. And an Xcel Energy proposal would make its pilot subscription rate permanent.

Duke Energy’s March 2022 commission-ordered rate design roadmap described plans for TVRs, subscription rates and its hourly pricing proposals.

The hourly prices “increase when the system is capacity constrained,” which ensures EV owners pay more for charging at those high-demand periods and protects other customers from a cross-subsidy, Duke’s Huber said.

And using the hourly pricing prudently could save high-volume EV charging stations “significantly on their average monthly bill,” Huber added.

In that way, Duke’s proposal is also a new approach to the demand charge issue for high-volume charging stations that many regulators, utilities and transportation electrification advocates are wrestling with.

The demand charge impediment

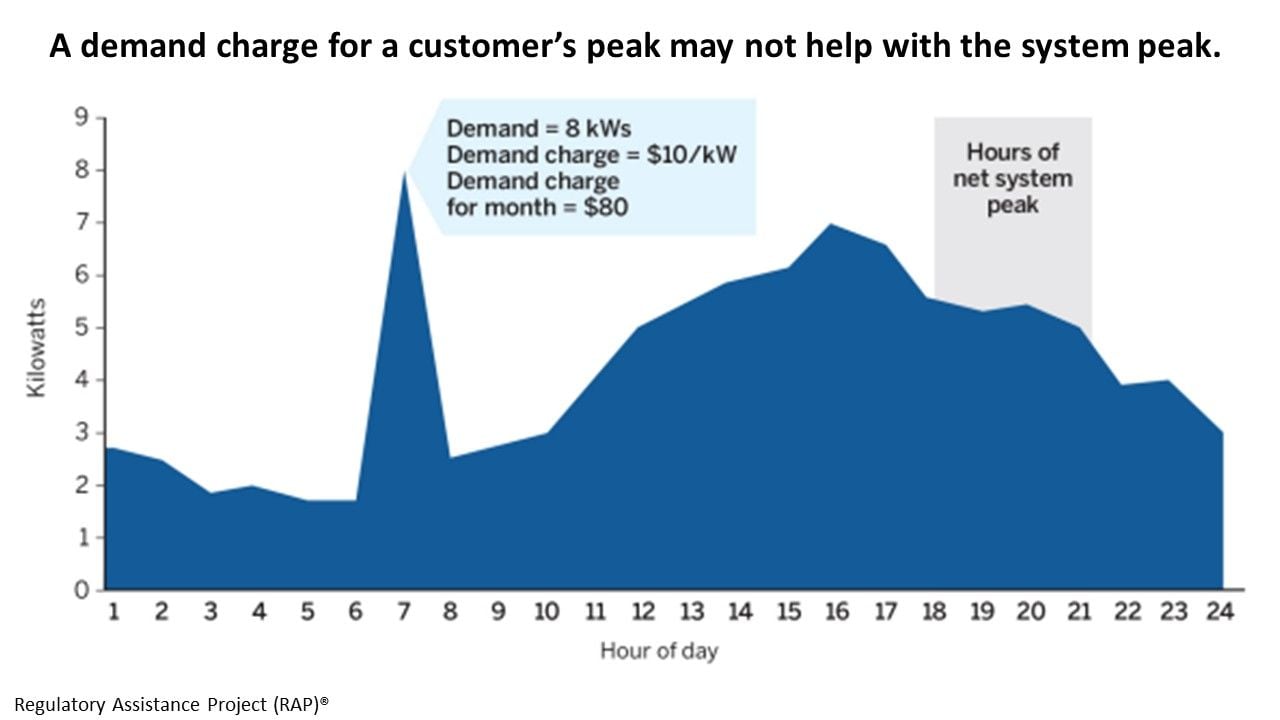

Any demand charge is a dollars-per-kW billing period assessment on the customer’s highest 15 minutes, 30 minutes or 60 minutes of electricity usage, according to a May 2022 Alliance for Transportation Electrification, or ATE, white paper. Charging stations with low utilization would need to recover a high demand charge by increasing the per-kWh rate charged to all customers, it added.

“A big box store’s peak draw might be about 500 kW, but a little-used fast charging station with just 16 outlets could draw 1.8 MW one hour and then draw zero kW for 80% of the time,” said Jim Lazar, a fellow with the Institute for Energy Democracy at PACE University’s Energy and Climate Center.

Utilities recover their costs through rates, and “the cost impact to the utility for serving that occasional 1.8 MW peak load, could be substantial,” Lazar added.

The charging station’s high per-kWh charging rate required to cover a demand charge from the utility to meet its costs can limit the station’s economic viability, ATE said. That could impede “much needed public EV charging stations” by EV service providers, ATE added.

The lack of demand charge innovations that both support EV service providers and allow utilities to recover costs could “negatively affect EV adoption levels,” ATE concluded.

Among the approaches to address the demand charge issue, “the dominant solutions now are a holiday for a specified number of years or a sliding scale linked to utilization,” NCCETC’s Proudlove said. “When utilization is high enough, the demand charge can be re-imposed or phased back in across customers without noticeably increasing the per-kWh charge,” she said.

In December, Massachusetts regulators approved a ten year demand charge adjustment for Eversource, National Grid, and Unitil based on utilization rates. In April, New Hampshire regulators ordered temporary demand charge holidays for Unitil and Liberty Utilities to allow utilization to rise.

In 2022, Georgia Power proposed a sliding scale demand charge until utilization reaches 15% and Entergy Texas proposed a demand charge adjustment expiring at a 15% monthly utilization. In January 2023, New York regulators approved demand charge reductions with adjustments at 10%, 15% and 20% utilization rates.

A still better idea

Demand charge holidays and sliding scales are temporary solutions, but most cost recovery should come through TVRs, RAP’s LeBel said. With the high levels of variable generation and load in today’s power system, most system peak needs are met by producing more energy or reducing load rather than by incurring new infrastructure costs, a LeBel co-authored 2020 RAP paper said.

Utilities are exploring demand charge adjustment proposals that include a TVR, a fixed charge, “a volumetric charge, and no demand charge or intent to add it back,” Proudlove said. That eliminates the “single interval” charge, simplifies the customer’s bill, “but sends a price signal to the customer to shift charging to reduce the total system peak demand so costs of service can be recovered,” she added.

Such rates, similar to the concept Duke has proposed, “can reflect cost of service without direct assessment of demand charges,” ATE agreed.

Duke’s pilot would offer “a dynamic hourly volumetric rate and a small demand charge to recover system costs for delivering the new transportation electrification loads,” Huber said. Hourly prices will reflect system costs by being higher during infrequent system demand spikes and lower at other times, he added.

If stations reduce charging “during the 100 hours to 200 hours each year when demand and prices spike, the utility can avoid new system investments,” Huber said. “Our calculations show they could possibly save up to 25% to 45% off our traditional three-part rate structures” at “only a small inconvenience” for shifting charging, he added.

With EV adoption still relatively low, and fast charging station deployment just beginning, the deliberate regulatory process from proposals to pilot programs to full-scale programs is working right now, EV advocates and analysts said. But rate design innovations cannot wait long, they also agreed.

“It is well established that things take longer to change than expected and then happen faster than expected,” the Institute for Energy Democracy’s Lazar cautioned.