The North American Electric Reliability Corp. (NERC) released its winter reliability assessment Wednesday, which finds grid operators have adequate generation resources and transmission to reliably serve demand this winter, with credit going to preparedness programs and new coordination initiatives.

Among the range of steps being taken, New England's grid operator has launched new periodic energy assessments aimed at providing information on fuel availability, and other ISOs have implemented enhanced communication and operating procedures.

Winter preparedness has been under particular scrutiny this year after brutally cold weather last season left some generators struggling with fuel issues and pushed grid operators to bring all resources to bear. The 2014 Polar vortex also challenged grid operators and revealed opportunities for improvements.

"From a capacity perspective, there is more than enough generation supply in service for the upcoming winter," said John Moura, NERC's director of reliability assessment, in a statement. He also warned that energy supplies in some areas "can be quickly depleted during prolonged and extreme cold weather conditions."

But a closer reading of NERC's report finds it won't be sheer capacity that keeps the lights on. Regionally, ISOs and RTOs are now in better communication with one another, providing more data to generators and ensuring adequate supplies of secondary fuels.

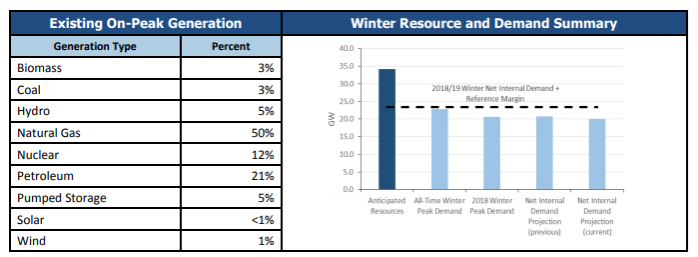

New York ISO

New York is a summer-peaking market, and is projecting adequate supplies and reserves for the winter ahead.

The New York ISO took steps following the 2014 winter to improve its situational awareness of natural gas system conditions and improved the monitoring of generator fuel inventories. The grid operator anticipates winter resource capacity, including generation, imports and demand response, of almost 44 GW, while extreme weather is not expected to push demand above 26 GW.

NERC's assessment found seasonal generator fuel surveys "indicate oil-burning units have sufficient start-of-winter inventories and arrangements for replacement fuel." Petroleum-based generation accounts for almost a quarter of New York's on-peak generation, while natural gas is 45%.

The grid operator has put in place emergency protocols to communicate electric reliability concerns to pipelines and natural gas operators, and NERC said the state's winter preparedness programs "have been effective in ensuring reliable operation of the BPS during cold weather months."

NYISO officials say about half of the grid operator's generators can burn both oil and natural gas, and about 6% of its installed capacity runs on oil alone.

"In winter, this ability to run on both oil and gas is important because of the increased demand for natural gas for building heating," spokesman Alan Wechsler told Utility Dive in an email.

"Although the actual amount of electric energy production by oil generation each year is variable and depends on many factors, having some oil generation is necessary each winter to support reliability as well as provide a hedge for consumers against gas price spikes," Wechsler said.

New England ISO

The grid operator for New England has instituted one of the more prominent market enhancements heading into this winter: a 21 day-ahead forecast of the region's available energy supplies, and developed a market mechanism to help ensure that fuel supplies are used most efficiently.

The ISO is forecasting a winter peak demand of 20,357 MW, but says under an "extreme winter" scenario, the peak could reach 21,057 MW. Available resources could reach almost 35,000 MW, according to NERC.

While the grid operator expects to meet demand, NERC's winter analysis said a "growing concern is whether there will be sufficient energy available to satisfy electricity demand during an extended cold spell given the evolving resource mix and fuel delivery infrastructure."

Since last winter, New England has added 1,650 MW of gas-fired generation, including an 850 MW dual-fueled unit, but NERC also said that a pay-for-performance market design has been implemented for the winter to provide financial incentives for capacity.

"Despite having sufficient capacity resources, power system operations could become challenging during periods of cold weather if fuel constraints impact the ability of generators to obtain fuel to produce electricity," NERC added.

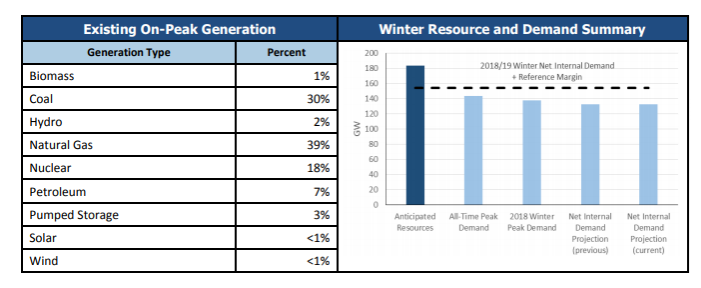

PJM Interconnection

PJM took some of the most involved steps following the 2014 Polar vortex, introducing a Capacity Performance pricing product that set up incentives for generators who delivered and penalties for those who did not. And earlier this year, the grid operator followed up on the cold snap by announcing a new initiative to value and price fuel security for power plants in its market.

PJM, which serves 65 million people, expects to have more than 185 GW of resources available this winter to meet the forecasted peak demand of 135.5 GW.

According to NERC, the region "has no emerging reliability issues." The market's capacity performance initiative provides for "very limited allowances for nonperformance or not producing when called upon" and increased capacity market revenues for dual-fuel capability and firm fuel service.

PJM officials say FERC approved revisions to its tariff and operating agreement on Dec. 4, extending the deadline to submit bids and offers into its day-ahead energy market from 10:30 a.m. to 11 a.m.

"The extension provides additional time for generators (natural gas generators, in particular) to interact with natural gas markets and gives them more price certainty when purchasing fuel," PJM spokesman Jason McGovern told Utility Dive in an email. "It is a further step in our ongoing work to enhance gas/electric coordination."

Midcontinent ISO

The Midcontinent ISO is expecting "ample resources" under normal operating conditions, but the grid operator said it is also prepared to "proactively manage potential challenges" created by periods of extreme weather or other issues.

MISO total capacity is about 140 GW heading into winter, with a projected peak of 103 GW.

"Part of MISO's available capacity is set aside for emergencies," NERC noted in its report. "When electricity supply drops below the required reserve levels, MISO's emergency operating procedures offer a variety of tools to maintain grid stability."

Those include emergency power purchases, demand response resources and "issuing public conservation appeals."