Dive Brief:

- New Jersey's clean energy ambitions are helping to fuel Public Service Enterprise Group's investments and earnings potential, company officials said Tuesday during a first-quarter earnings call with journalists and financial analysts.

- PSEG has a five-year capital spending plan of $15-17 billion, with about 90% of that directed towards its utility subsidiary Public Service Electric and Gas. The utility remains "on track" to invest $2.9 billion this year as part of that plan, said President, Chairman and CEO Ralph Izzo.

- Izzo also said PSE&G hopes to receive approval from the New Jersey Board of Public Utilities this fall on a four-year plan to invest $848 million upgrading the "last mile" of the distribution system. "Confidential settlement discussions are scheduled to begin within the next week," Izzo said.

Dive Insight:

State clean energy goals and PSEG's commitment to net-zero carbon by 2030 are fueling growth in the utility's rate base, and the company expects the trend to continue at least through 2025.

New Jersey wants to achieve 100% clean energy by 2050.

"Our regulated investment programs are producing predictable utility growth," Izzo said. And the utility's conservation incentive program "is effectively minimizing variations on electric and gas revenues from the rollout of our energy efficiency programs and other impacts, including weather."

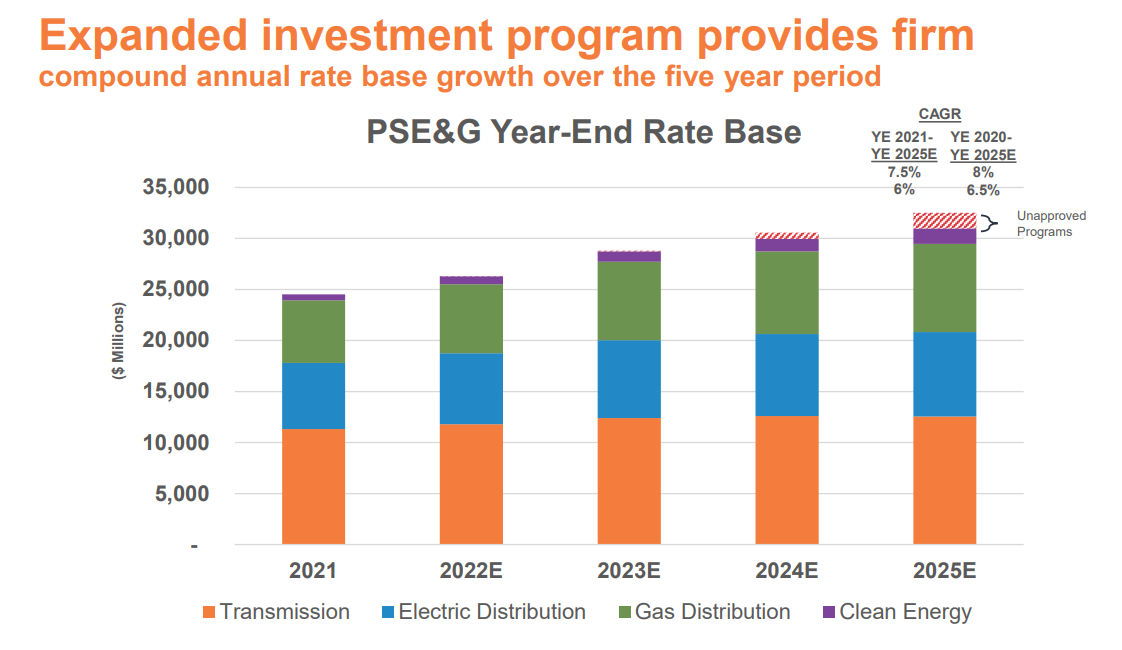

Over 90% of PSEG's capital spending plan is directed at its regulated utility subsidiary, and Izzo said it is expected to produce compound annual growth rates in its rate base ranging from 6-7.5% over the 2022-2025 period. PSE&G's rate base was approximately $25 billion at the end of 2021, he said. The company's presentation anticipates that the rate base in 2025 will exceed $30 billion.

Investments pending approval are included in those 2025 rate base numbers. New Jersey regulators are considering whether to approve PSE&G's infrastructure advancement program, which would address older substations and gas metering and regulating stations, and make improvements to the distribution system in order to integrate electric vehicle charging infrastructure.

The discovery phase, which includes the utility responding to inquiries from Board of Public Utilities staff, "is coming to a conclusion" and settlement discussions are expected to begin soon, said Izzo. "We continue to expect, based on the current procedural schedule, that final BPU action will take place this fall," he said.

PSE&G first quarter 2022 net income was up 6.7%, compared with 2021. The utility saw roughly 1% growth in the number of electric and gas customers during the trailing 12 month period.

New Jersey's COVID-19 moratorium on utility shutoffs was lifted in mid-March, and electric and gas utilities are owed more than $800 million in unpaid bills. PSE&G officials say they are working with the BPU and community groups to help customers find payment programs and provide deferred payment arrangements.

"We recognize the continued economic strain that the pandemic has brought to many of our customers and we will continue to work with empathy as we conduct our collection efforts," Izzo said.

Parent company PSEG reported a net loss of $2 million, but non-GAAP operating earnings were $1.33/share for the first quarter.

The operating earnings for the first quarter "reflect solid utility and nuclear operations," Izzo said. "That foundation, combined with rate-based growth from regulated investments, as well as lower-cost resulting from the completed sale of PSEG Fossil, offset lower capacity and recontracting this quarter."

PSEG in February completed the sale of its fossil fuel generating portfolio to subsidiaries of ArcLight Energy Partners Fund VII, allowing the utility company to focus on clean energy and regulated utility investments, it said.